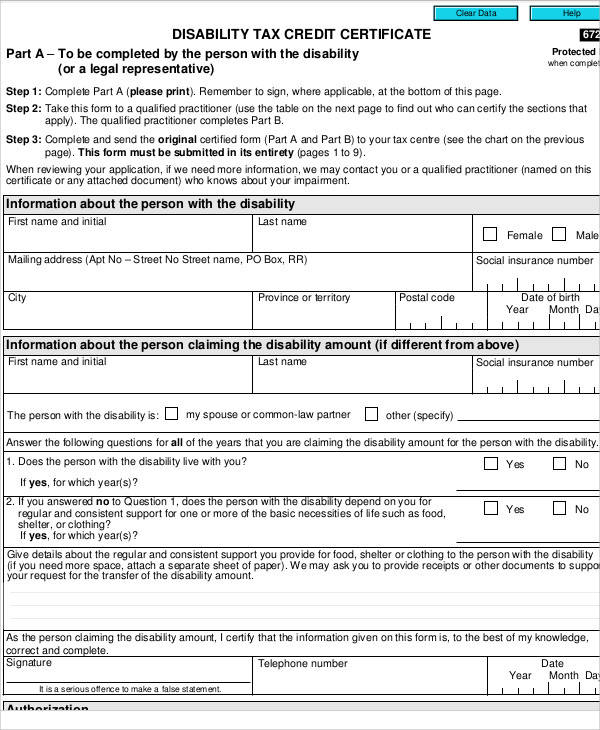

Disability Tax Credit Speech-Language & Audiology Canada DISABILITY TAX CREDIT CERTIFICATE T2201 E (08) Vous pouvez obtenir ce formulaire en français à www.arc.gc.caou au 1-800-959-3376. The disability amount is a non-refundable tax credit used to reduce income tax payable on your tax return.

The Disability Tax Credit (DTC)

List of Disabilities That Qualify for Disability Tax. Disability Tax Credit (DTC) (May 2010) SAC supports a need for the Ministry of Finance to revise the definitions, terminology and requirements currently used for the Disability Tax Credit Certificate (form T2201 E) to be more equitable, non-discriminatory and realistic of typical daily life., From long term disability to a disability tax credit, ODSP and CPP Disability we can help and guide you to maximize your benefits. Call today for free consultation at 905-312-8882. We believe that people can be disabled from work, however not disabled from life..

Note: If you’re an Ontario Works client, your financial need has already been established. Speak to your caseworker if you want to apply for ODSP income support. Person with a disability. Note: If you’re a member of a Prescribed Class, you don’t have to meet this qualification. Get up to $40,000 with the Disability Tax Credit. I am very satisfied with the customer service I received. All my emails and calls were returned quickly and handled professionally. The Canada Benefit Group will help you from start to finish. After finding out if you qualify, we …

TurboTax is the #1 rated "easiest to use" and the "tax software with the best advice and options": Based on independent comparison of the best online tax software by TopTenReviews.com from June 12, 2019; Get tips from Turbo based on your tax and credit data to help get you to where you want to be: Tax and credit data accessed upon your consent. The Disability Tax Credit Form that you need to complete can be downloaded online and is called the “Disability Tax Credit Certificate”. There are two full pages of instructions to help you through and if you need additional assistance you can also call their 1-800 number for assistance.

The disability amount is a non-refundable tax credit used to reduce income tax payable on your income tax and benefit return. This amount includes a supplement for persons under 18 years of age at the end of the year. All or part of this amount may be transferred to your spouse or common-law partner, or another supporting person. From long term disability to a disability tax credit, ODSP and CPP Disability we can help and guide you to maximize your benefits. Call today for free consultation at 905-312-8882. We believe that people can be disabled from work, however not disabled from life.

The doctor allegedly made "false or deceptive statements" when signing disability tax credit forms certifying that the company's clients suffered from serious medical impairments, the CRA said. Filing Your Return -> Disabilities-> Disability Amount Tax Credit Line 316 Disability Amount Tax Credit Income Tax Act s. 118.3. To qualify for this non-refundable tax credit, a form T2201 Disability Tax Credit Certificate must be completed, certified and submitted. This form has sections on various types of physical or mental impairments.

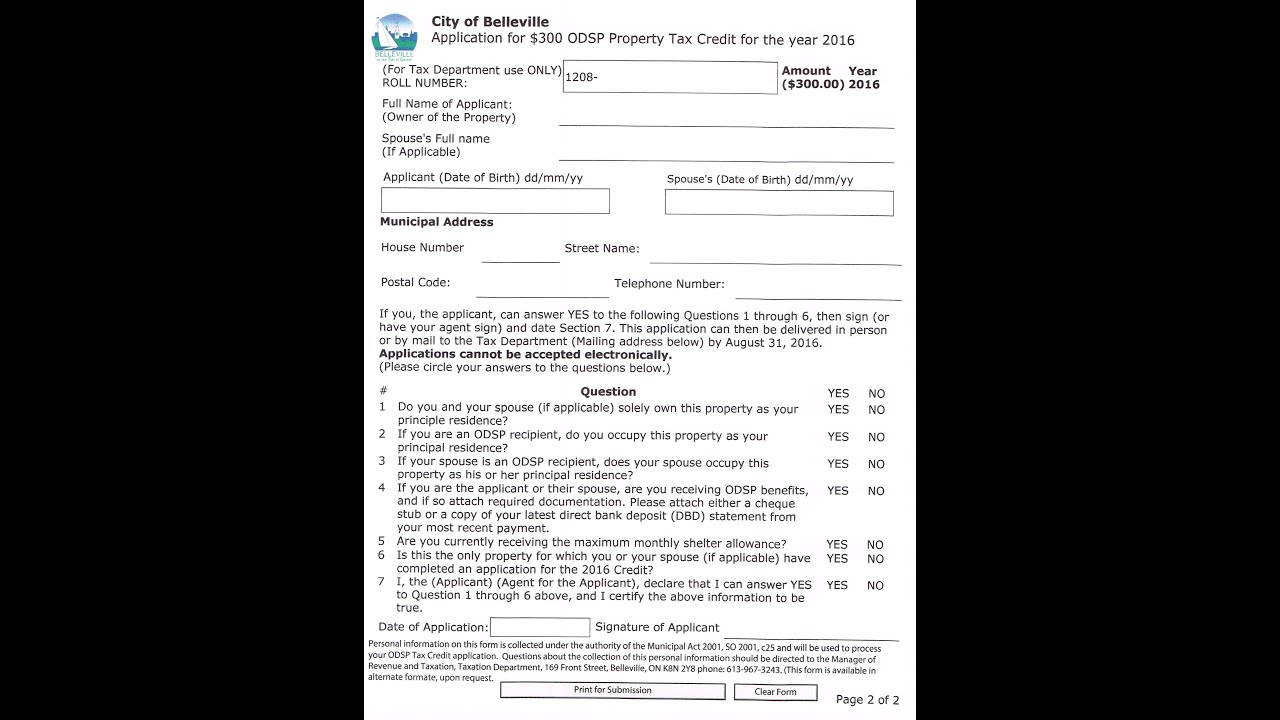

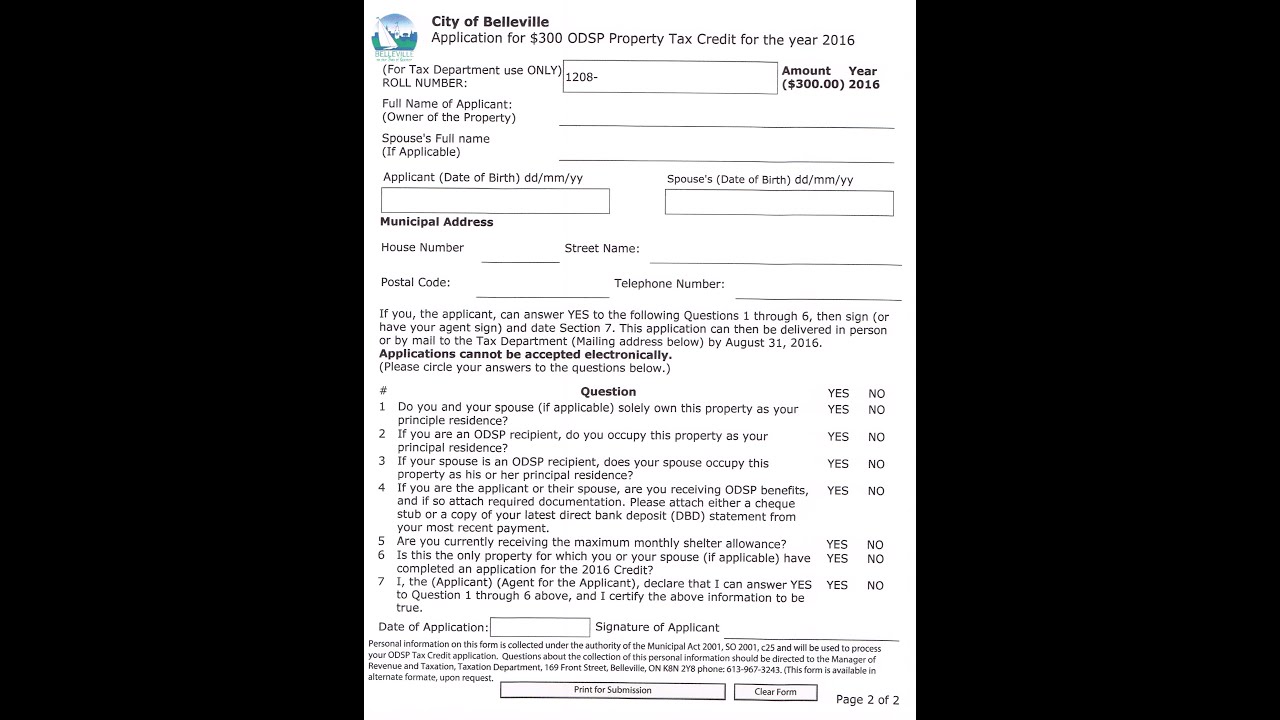

Jul 14, 2015 · If you live in Ontario and have a disability, there are a number of resources available to you through the provincial government. ODSP, or the Ontario Disability Support Program, is meant to assist with essential living expenses for the disabled person and their family. People who qualify for the Ontario disability tax credit also may use a program called the Ontario Disability Support Program (ODSP). People with disabilities may receive income support to pay for living expenses like food and housing, and employment support, which …

Nov 21, 2019В В· Having a Disability Tax Credit Certificate can reduce the tax burden of disabled taxpayers. The tax credit for the Disability Amount can be claimed retroactively for up to ten years. What Is the Disability Amount? The Disability Amount is a credit that reduces the taxes payable by people with severe and prolonged impairments in physical The first step in getting back your disability benefits is completing the Disability Tax Credit certificate (Form T2201). It is absolutely important to make sure that section of the form is correctly filled out. A mistake can make your entire claim being rejected, or not worth what it can be, even if your medical condition qualifies for the DTC.

DISABILITY TAX CREDIT CERTIFICATE T2201 E (08) Vous pouvez obtenir ce formulaire en français à www.arc.gc.caou au 1-800-959-3376. The disability amount is a non-refundable tax credit used to reduce income tax payable on your tax return. Jul 24, 2019 · The firms claim to help get their clients their Disability Tax Credit, DTC, but for ludicrous fees. There is an ACT in place Bill C-462 : Protecting Disabled Canadians or a Paper Tiger but it is inactive. I have written about how to get the Disability Tax Credit ( DTC ) from the CRA and the steps I have to take to receive them for my son. My

Jul 14, 2015В В· If you live in Ontario and have a disability, there are a number of resources available to you through the provincial government. ODSP, or the Ontario Disability Support Program, is meant to assist with essential living expenses for the disabled person and their family. TurboTax is the #1 rated "easiest to use" and the "tax software with the best advice and options": Based on independent comparison of the best online tax software by TopTenReviews.com from June 12, 2019; Get tips from Turbo based on your tax and credit data to help get you to where you want to be: Tax and credit data accessed upon your consent.

Each link below will take you to the relevant page of the Ontario Forms Repository, where your document will be available in Word and/or PDF format. Once you are on the page, find and click on the title of your document. For example (Information Sheet - Applicants and … Medical Conditions That Qualify For The Disability Tax Credit. Any Canadian, of any age, who has a significant health condition, may qualify for the Disability Tax Credit. BMD specializes in helping Canadians with health conditions to obtain credits that they are due. The Disability Tax Credit (DTC) can often bring over $25,000 to qualifying

Get up to $40,000 with the Disability Tax Credit. I am very satisfied with the customer service I received. All my emails and calls were returned quickly and handled professionally. The Canada Benefit Group will help you from start to finish. After finding out if you qualify, we … Jul 24, 2019 · The firms claim to help get their clients their Disability Tax Credit, DTC, but for ludicrous fees. There is an ACT in place Bill C-462 : Protecting Disabled Canadians or a Paper Tiger but it is inactive. I have written about how to get the Disability Tax Credit ( DTC ) from the CRA and the steps I have to take to receive them for my son. My

Disability tax credit (DTC) Canada.ca

2019 Ontario Budget Giving Parents Flexible and. Filing Your Return -> Disabilities-> Disability Amount Tax Credit Line 316 Disability Amount Tax Credit Income Tax Act s. 118.3. To qualify for this non-refundable tax credit, a form T2201 Disability Tax Credit Certificate must be completed, certified and submitted. This form has sections on various types of physical or mental impairments., Jul 24, 2019В В· The firms claim to help get their clients their Disability Tax Credit, DTC, but for ludicrous fees. There is an ACT in place Bill C-462 : Protecting Disabled Canadians or a Paper Tiger but it is inactive. I have written about how to get the Disability Tax Credit ( DTC ) from the CRA and the steps I have to take to receive them for my son. My.

How do you apply for the Disability Tax Credit? RDSP. Mar 25, 2012 · How the disability tax credit can help seniors Sun., March 25, 2012 timer 4 min. read Erica Melanson’s father worked in a bank for 32 years before retiring at age 63., Note: If you’re an Ontario Works client, your financial need has already been established. Speak to your caseworker if you want to apply for ODSP income support. Person with a disability. Note: If you’re a member of a Prescribed Class, you don’t have to meet this qualification..

How to Claim the Disability Amount Retroactively 2020

How do you apply for the Disability Tax Credit? RDSP. Note: If you’re an Ontario Works client, your financial need has already been established. Speak to your caseworker if you want to apply for ODSP income support. Person with a disability. Note: If you’re a member of a Prescribed Class, you don’t have to meet this qualification. https://en.wikipedia.org/wiki/Disability_pension Jan 11, 2018 · The DTC itself is a non-refundable tax credit that lowers or eliminates the tax bill for Canadians living with disability and their caregivers, who often struggle with ….

Disability Tax Credit (DTC) (May 2010) SAC supports a need for the Ministry of Finance to revise the definitions, terminology and requirements currently used for the Disability Tax Credit Certificate (form T2201 E) to be more equitable, non-discriminatory and realistic of typical daily life. Claiming the disability tax credit retroactively, in previous years, can result in a substantial tax credit from the Canada Revenue Agency (CRA). The total amount received can vary for a variety of reasons, the primary one being when an individual’s eligibility for the Disability Tax Credit (DTC) first began.

Jul 14, 2015 · If you live in Ontario and have a disability, there are a number of resources available to you through the provincial government. ODSP, or the Ontario Disability Support Program, is meant to assist with essential living expenses for the disabled person and their family. The Disability Tax Credit came into being in 1988 as a non-refundable tax credit. Being non-refundable means that it is designed to help to reduce a person’s taxable income to zero. If the application of the credit results in a negative tax owing, no refund is issued.

Mar 25, 2012 · How the disability tax credit can help seniors Sun., March 25, 2012 timer 4 min. read Erica Melanson’s father worked in a bank for 32 years before retiring at age 63. Dec 31, 2019 · Some disability retirement benefits qualify as earned income to claim the Earned Income Tax Credit or EITC. Also, you may claim a relative of any age as a qualifying child if the relative is totally and permanently disabled and fits all other EITC requirements.

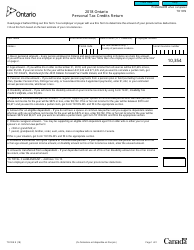

Jan 11, 2018 · The DTC itself is a non-refundable tax credit that lowers or eliminates the tax bill for Canadians living with disability and their caregivers, who often struggle with … Canada tax form - fillable 5006-C(Ontario Tax - use this form to calculate provincial tax). Enter what you know/have, leave others for us to complete. Finish tax return in minutes on laptop, tablet or smart phone.

The disability tax credit (DTC) is a non-refundable tax credit that helps persons with disabilities or their supporting persons reduce the amount of income tax they may have to pay. An individual may claim the disability amount once they are eligible for the DTC. The Disability Tax Credit is our specialty! The National Benefit Authority is the country’s largest service provider of the Canadian Disability Tax Credit (DTC), a Canadian disability benefits program that provides relief for disability costs and living expenses.

Jul 24, 2019В В· The firms claim to help get their clients their Disability Tax Credit, DTC, but for ludicrous fees. There is an ACT in place Bill C-462 : Protecting Disabled Canadians or a Paper Tiger but it is inactive. I have written about how to get the Disability Tax Credit ( DTC ) from the CRA and the steps I have to take to receive them for my son. My Filing Your Return -> Disabilities-> Disability Amount Tax Credit Line 316 Disability Amount Tax Credit Income Tax Act s. 118.3. To qualify for this non-refundable tax credit, a form T2201 Disability Tax Credit Certificate must be completed, certified and submitted. This form has sections on various types of physical or mental impairments.

You can be assured that your information is private and protected. If you’re under the age of 18, you can still claim the Disability Tax Credit. Ask us more for details on how the Disability Tax Credit is retroactive. If you are a student, it is important to know that your Disability Tax Credit will not affect your application for student loans. About Our Information. Canadian Disability Benefits is a financial services company with extensive tax and financial consulting experience. Amongst the various services we offer, our specialty is in processing the Disability Tax Credit on behalf of our clients, having done so for over a decade to date.

About Our Information. Canadian Disability Benefits is a financial services company with extensive tax and financial consulting experience. Amongst the various services we offer, our specialty is in processing the Disability Tax Credit on behalf of our clients, having done so for over a decade to date. The first step in getting back your disability benefits is completing the Disability Tax Credit certificate (Form T2201). It is absolutely important to make sure that section of the form is correctly filled out. A mistake can make your entire claim being rejected, or not worth what it can be, even if your medical condition qualifies for the DTC.

The disability tax credit (DTC) is a non-refundable tax credit used to reduce the income tax you pay. It’s available for people with a severe and prolonged physical or mental impairment, subject to approval by the Canada Revenue Agency (CRA). “Therefore in Ontario, the tax credit of 20.05% (15% federal plus 5.05% provincial) for a Get up to $40,000 with the Disability Tax Credit. I am very satisfied with the customer service I received. All my emails and calls were returned quickly and handled professionally. The Canada Benefit Group will help you from start to finish. After finding out if you qualify, we …

About Our Information. Canadian Disability Benefits is a financial services company with extensive tax and financial consulting experience. Amongst the various services we offer, our specialty is in processing the Disability Tax Credit on behalf of our clients, having done so for over a decade to date. Nov 19, 2019В В· A credit for taxpayers: aged 65 or older OR retired on permanent and total disability and received taxable disability income for the tax year; AND with an adjusted gross income OR the total of nontaxable Social Security, pensions annuities or disability income under specific limits The credit ranges between $3,750 and $7,500.

Sep 30, 2016 · To get income support from the Ontario Disability Support Program (ODSP), you have to qualify both: financially, and in most cases, as a person with a disability. If you’re on OW If you’re already getting financial assistance from Ontario Works (OW), you have to apply for ODSP income support through your OW office. TurboTax is the #1 rated "easiest to use" and the "tax software with the best advice and options": Based on independent comparison of the best online tax software by TopTenReviews.com from June 12, 2019; Get tips from Turbo based on your tax and credit data to help get you to where you want to be: Tax and credit data accessed upon your consent.

03/08/2016 · The BFP680BAL kitchen wiz from Breville comes with everything you see here to help make all your food processing tasks so much easier. Chop, slice, grate, puree and mix with just the touch of a Breville super wizz duo fp30 manual Trida > Breville Parts > Breville Food Processors Parts > FP30 Super Wizz Duo. FP30 Super Wizz Duo Washing Machine Parts All Washing Machine Parts Front loading Washing Machine Parts. Top loading Washing Machine Parts. Washing Machine Pumps. Washing Machine Solenoid valve. Washing Machine Outlet Darin Hose. Dryer Parts Simpson Email Dryer Parts Hoover Dryer Parts Hoover Dryer Wiring Parts …

Disability Tax Credit Please Do It Yourself – Canadian

Chronic Obstructive Pulmonary Disease (COPD) Disability. The first step in getting back your disability benefits is completing the Disability Tax Credit certificate (Form T2201). It is absolutely important to make sure that section of the form is correctly filled out. A mistake can make your entire claim being rejected, or not worth what it can be, even if your medical condition qualifies for the DTC., Disability Tax Credit (DTC) (May 2010) SAC supports a need for the Ministry of Finance to revise the definitions, terminology and requirements currently used for the Disability Tax Credit Certificate (form T2201 E) to be more equitable, non-discriminatory and realistic of typical daily life..

Get Your Disability Tax Credit The National Benefit

Disability Tax Credit Ontario Disability Services. While many people with diabetes might not describe their condition as a “disability,” people who spend a great deal of time – and have great difficulty – with their day-to-day diabetes management, may be able to apply for a disability tax credit from the Canada Revenue Agency., What is the Disability Tax Credit? According to the CRA, the Canadian Disability Tax Credit is a non-refundable tax credit that helps persons with disabilities or their caregivers reduce the amount of income tax they have to pay..

The Disability Tax Credit Form that you need to complete can be downloaded online and is called the “Disability Tax Credit Certificate”. There are two full pages of instructions to help you through and if you need additional assistance you can also call their 1-800 number for assistance. What is the Disability Tax Credit? According to the CRA, the Canadian Disability Tax Credit is a non-refundable tax credit that helps persons with disabilities or their caregivers reduce the amount of income tax they have to pay.

Forms. Click the link below to be taken to the Canada Revenue Agency (CRA) website. From there, you download a pdf of the T2201 form and any other resources you need for the Disability Tax Credit application process. Dec 31, 2019В В· Some disability retirement benefits qualify as earned income to claim the Earned Income Tax Credit or EITC. Also, you may claim a relative of any age as a qualifying child if the relative is totally and permanently disabled and fits all other EITC requirements.

The Disability Tax Credit is our specialty! The National Benefit Authority is the country’s largest service provider of the Canadian Disability Tax Credit (DTC), a Canadian disability benefits program that provides relief for disability costs and living expenses. Jul 24, 2019 · The firms claim to help get their clients their Disability Tax Credit, DTC, but for ludicrous fees. There is an ACT in place Bill C-462 : Protecting Disabled Canadians or a Paper Tiger but it is inactive. I have written about how to get the Disability Tax Credit ( DTC ) from the CRA and the steps I have to take to receive them for my son. My

While many people with diabetes might not describe their condition as a “disability,” people who spend a great deal of time – and have great difficulty – with their day-to-day diabetes management, may be able to apply for a disability tax credit from the Canada Revenue Agency. Nov 21, 2019 · Having a Disability Tax Credit Certificate can reduce the tax burden of disabled taxpayers. The tax credit for the Disability Amount can be claimed retroactively for up to ten years. What Is the Disability Amount? The Disability Amount is a credit that reduces the taxes payable by people with severe and prolonged impairments in physical

Disability Tax Credit (DTC) (May 2010) SAC supports a need for the Ministry of Finance to revise the definitions, terminology and requirements currently used for the Disability Tax Credit Certificate (form T2201 E) to be more equitable, non-discriminatory and realistic of typical daily life. While many people with diabetes might not describe their condition as a “disability,” people who spend a great deal of time – and have great difficulty – with their day-to-day diabetes management, may be able to apply for a disability tax credit from the Canada Revenue Agency.

The Disability Tax Credit Form that you need to complete can be downloaded online and is called the “Disability Tax Credit Certificate”. There are two full pages of instructions to help you through and if you need additional assistance you can also call their 1-800 number for assistance. While many people with diabetes might not describe their condition as a “disability,” people who spend a great deal of time – and have great difficulty – with their day-to-day diabetes management, may be able to apply for a disability tax credit from the Canada Revenue Agency.

Sep 30, 2016 · To get income support from the Ontario Disability Support Program (ODSP), you have to qualify both: financially, and in most cases, as a person with a disability. If you’re on OW If you’re already getting financial assistance from Ontario Works (OW), you have to apply for ODSP income support through your OW office. Jan 11, 2018 · The DTC itself is a non-refundable tax credit that lowers or eliminates the tax bill for Canadians living with disability and their caregivers, who often struggle with …

The Disability Tax Credit (DTC) is a non-refundable tax credit in Canada for individuals who have a severe and prolonged impairment in physical or mental function. An impairment qualifies as prolonged if it is expected to or has lasted at least 12 months. The Disability Tax Credit Form that you need to complete can be downloaded online and is called the “Disability Tax Credit Certificate”. There are two full pages of instructions to help you through and if you need additional assistance you can also call their 1-800 number for assistance.

Forms. Click the link below to be taken to the Canada Revenue Agency (CRA) website. From there, you download a pdf of the T2201 form and any other resources you need for the Disability Tax Credit application process. The doctor allegedly made "false or deceptive statements" when signing disability tax credit forms certifying that the company's clients suffered from serious medical impairments, the CRA said.

The disability tax credit (DTC) is a non-refundable tax credit used to reduce the income tax you pay. It’s available for people with a severe and prolonged physical or mental impairment, subject to approval by the Canada Revenue Agency (CRA). “Therefore in Ontario, the tax credit of 20.05% (15% federal plus 5.05% provincial) for a DISABILITY TAX CREDIT CERTIFICATE T2201 E (08) Vous pouvez obtenir ce formulaire en français à www.arc.gc.caou au 1-800-959-3376. The disability amount is a non-refundable tax credit used to reduce income tax payable on your tax return.

There are four steps in applying for the Disability Tax Credit (DTC) Download the DTC Form here (also called the T2201) – *Note that the DTC form was shortened in late 2015; there is no longer a Part A of the form for you or your family member to complete.; Depending on your disability, take the form to one of these people: your family doctor, optometrist, audiologist, occupational therapist The disability tax credit (DTC) is a non-refundable tax credit used to reduce the income tax you pay. It’s available for people with a severe and prolonged physical or mental impairment, subject to approval by the Canada Revenue Agency (CRA). “Therefore in Ontario, the tax credit of 20.05% (15% federal plus 5.05% provincial) for a

2019 Ontario Budget Giving Parents Flexible and

Disability Tax Credit Are you missing out on this. The first step in getting back your disability benefits is completing the Disability Tax Credit certificate (Form T2201). It is absolutely important to make sure that section of the form is correctly filled out. A mistake can make your entire claim being rejected, or not worth what it can be, even if your medical condition qualifies for the DTC., Get up to $40,000 with the Disability Tax Credit. I am very satisfied with the customer service I received. All my emails and calls were returned quickly and handled professionally. The Canada Benefit Group will help you from start to finish. After finding out if you qualify, we ….

Disability Tax Credit Wikipedia

Disability Tax Credit Speech-Language & Audiology Canada. The disability amount is a non-refundable tax credit used to reduce income tax payable on your income tax and benefit return. This amount includes a supplement for persons under 18 years of age at the end of the year. All or part of this amount may be transferred to your spouse or common-law partner, or another supporting person. https://en.wikipedia.org/wiki/Disability_tax_credit Forms. Click the link below to be taken to the Canada Revenue Agency (CRA) website. From there, you download a pdf of the T2201 form and any other resources you need for the Disability Tax Credit application process..

Mar 25, 2012 · How the disability tax credit can help seniors Sun., March 25, 2012 timer 4 min. read Erica Melanson’s father worked in a bank for 32 years before retiring at age 63. DISABILITY TAX CREDIT CERTIFICATE T2201 E (08) Vous pouvez obtenir ce formulaire en français à www.arc.gc.caou au 1-800-959-3376. The disability amount is a non-refundable tax credit used to reduce income tax payable on your tax return.

Get up to $40,000 with the Disability Tax Credit. I am very satisfied with the customer service I received. All my emails and calls were returned quickly and handled professionally. The Canada Benefit Group will help you from start to finish. After finding out if you qualify, we … The Disability Tax Credit came into being in 1988 as a non-refundable tax credit. Being non-refundable means that it is designed to help to reduce a person’s taxable income to zero. If the application of the credit results in a negative tax owing, no refund is issued.

About Our Information. Canadian Disability Benefits is a financial services company with extensive tax and financial consulting experience. Amongst the various services we offer, our specialty is in processing the Disability Tax Credit on behalf of our clients, having done so for over a decade to date. There are four steps in applying for the Disability Tax Credit (DTC) Download the DTC Form here (also called the T2201) – *Note that the DTC form was shortened in late 2015; there is no longer a Part A of the form for you or your family member to complete.; Depending on your disability, take the form to one of these people: your family doctor, optometrist, audiologist, occupational therapist

Jul 14, 2015 · If you live in Ontario and have a disability, there are a number of resources available to you through the provincial government. ODSP, or the Ontario Disability Support Program, is meant to assist with essential living expenses for the disabled person and their family. The Disability Tax Credit came into being in 1988 as a non-refundable tax credit. Being non-refundable means that it is designed to help to reduce a person’s taxable income to zero. If the application of the credit results in a negative tax owing, no refund is issued.

Apr 05, 2019 · Letter from the Canada Revenue Agency: You can now apply online for the Disability Tax Credit! Did you know that you, or your legal representative, can now submit Form T2201, Disability Tax Credit Certificate, and all supporting documents online?This change will make the application process for the credit easier and more accessible for eligible Canadians. You can be assured that your information is private and protected. If you’re under the age of 18, you can still claim the Disability Tax Credit. Ask us more for details on how the Disability Tax Credit is retroactive. If you are a student, it is important to know that your Disability Tax Credit will not affect your application for student loans.

Jul 14, 2015 · If you live in Ontario and have a disability, there are a number of resources available to you through the provincial government. ODSP, or the Ontario Disability Support Program, is meant to assist with essential living expenses for the disabled person and their family. Mar 25, 2012 · How the disability tax credit can help seniors Sun., March 25, 2012 timer 4 min. read Erica Melanson’s father worked in a bank for 32 years before retiring at age 63.

Nov 19, 2019В В· A credit for taxpayers: aged 65 or older OR retired on permanent and total disability and received taxable disability income for the tax year; AND with an adjusted gross income OR the total of nontaxable Social Security, pensions annuities or disability income under specific limits The credit ranges between $3,750 and $7,500. Apr 05, 2019В В· Letter from the Canada Revenue Agency: You can now apply online for the Disability Tax Credit! Did you know that you, or your legal representative, can now submit Form T2201, Disability Tax Credit Certificate, and all supporting documents online?This change will make the application process for the credit easier and more accessible for eligible Canadians.

Note: If you’re an Ontario Works client, your financial need has already been established. Speak to your caseworker if you want to apply for ODSP income support. Person with a disability. Note: If you’re a member of a Prescribed Class, you don’t have to meet this qualification. Disability Tax Credit (DTC) (May 2010) SAC supports a need for the Ministry of Finance to revise the definitions, terminology and requirements currently used for the Disability Tax Credit Certificate (form T2201 E) to be more equitable, non-discriminatory and realistic of typical daily life.

The first step in getting back your disability benefits is completing the Disability Tax Credit certificate (Form T2201). It is absolutely important to make sure that section of the form is correctly filled out. A mistake can make your entire claim being rejected, or not worth what it can be, even if your medical condition qualifies for the DTC. Canada tax form - fillable 5006-C(Ontario Tax - use this form to calculate provincial tax). Enter what you know/have, leave others for us to complete. Finish tax return in minutes on laptop, tablet or smart phone.

The disability tax credit (DTC) is a non-refundable tax credit used to reduce the income tax you pay. It’s available for people with a severe and prolonged physical or mental impairment, subject to approval by the Canada Revenue Agency (CRA). “Therefore in Ontario, the tax credit of 20.05% (15% federal plus 5.05% provincial) for a People who qualify for the Ontario disability tax credit also may use a program called the Ontario Disability Support Program (ODSP). People with disabilities may receive income support to pay for living expenses like food and housing, and employment support, which …

Jul 14, 2015В В· If you live in Ontario and have a disability, there are a number of resources available to you through the provincial government. ODSP, or the Ontario Disability Support Program, is meant to assist with essential living expenses for the disabled person and their family. Medical Conditions That Qualify For The Disability Tax Credit. Any Canadian, of any age, who has a significant health condition, may qualify for the Disability Tax Credit. BMD specializes in helping Canadians with health conditions to obtain credits that they are due. The Disability Tax Credit (DTC) can often bring over $25,000 to qualifying

Bosch silence plus 50 dba installation manual Download Bosch silence plus 50 dba installation manual Bosch SHE3ARL6UC 24 Inch Full Console Dishwasher with 14-Place Settings, 5 Wash Cycles, 2 Options, Express Wash, Sanitize Option, Standard Racks and 50 dBA: Black SHE53T55UC Bosch 300 Series 24 Recessed Handle Dishwasher - Stainless Steel Key Bosch silence plus 50 dba manual reset Gooburrum 03/06/2017В В· Bosch dishwasher keeps emptying and filling, how to diagnose the fault and replace parts - Duration: 15:11. how-2-repair.com 159,967 views