FAQ Personal Income Tax Returns - - Growthwise Sep 02, 2019 · Can i lodge my tax return by paper for 2016, as i have using paper return from last few years, i have downloaded the paper form..portable document …

All about your tax return Canada.ca

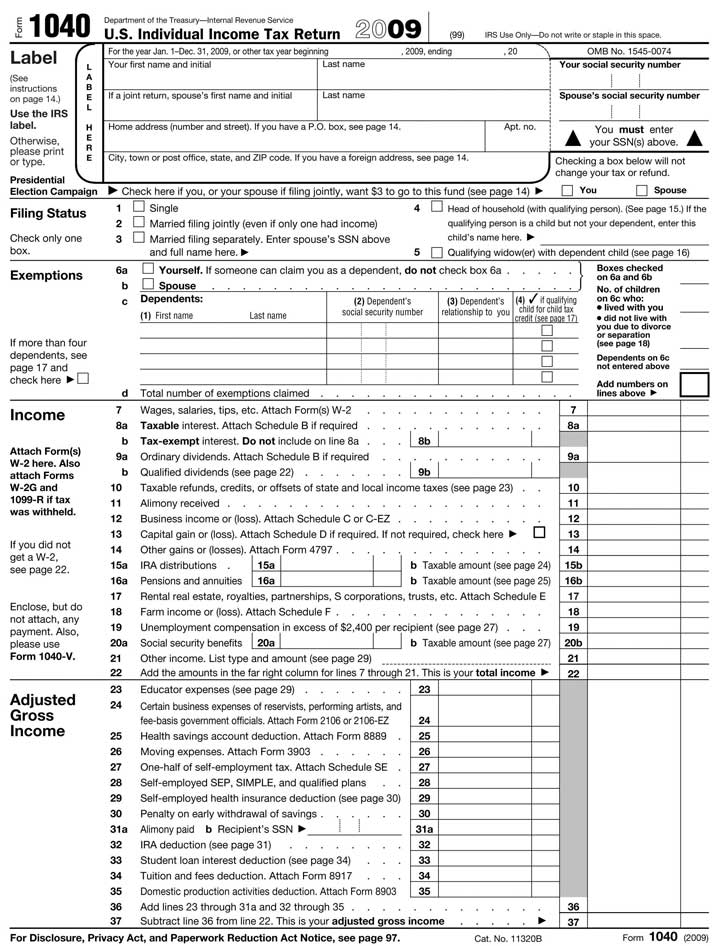

1040-SR The New Tax Return Form for Seniors. Nov 05, 2019 · Information about Form 1040-A, U.S. Individual Income Tax Return, including recent updates, related forms and instructions on how to file. Form 1040-A is used by citizens and residents of the United States who have varied incomes and would like to take various deductions., Jul 07, 2014 · 30 August 2019. The tax return form for tax year 2018 to 2019 has been updated. 6 April 2019. The Tax return form and notes have been added for tax year 2018 to ….

The ATO has an online tool called myTax, which is a tax return setup inside the myGov government web portal. It is one of many ways you can choose to get your taxes done. To do your tax return at myGov, you need to set up a myGov account and enter all your personal details on the Government online system. return is filed, a penalty will be charged for filing the return late. If you cannot determine whether the return will sh ow a balance due, file Form 200 ES for an extension. To extend your due date for submitting your completed income tax return (from April 30, 2019 to October 15, 2019 ), submit the following to the Division of Reve nue no

Section of the Income Tax Return Yes No N/A 14 Personal services income (PSI) Is the client a sole trader? Did the client receive personal services income? If this is the case, obtained details and completed the P1 so that the ATO can calculate the small business tax offset. Take a look at the Etax Accountants Online Tax Return and you could complete your taxes in less than 15 minutes! The Etax Accountants personal tax return – an online platform with face-to-face service. Behind our simple, user friendly online tax return you’ll meet some very nice, very real people.

Claiming a tax deduction for personal super contributions Issued by AustralianSuper Pty Ltd ABN 94 006 457 987 AFSL 233788 Trustee of AustralianSuper ABN 65 714 394 898 You may be able to claim a tax deduction for any personal super contributions on your next income tax return. When to claim Once you make a contribution, you have until the 1040-SR: The New Tax Return Form for Seniors Those who are not yet 65 and who have Social Security income, pension income, or other forms of retirement income can’t use Form 1040-SR because of the age requirement; and because Form 1040-EZ doesn't include Social Security and pension income, they can't use that, either.

Aug 29, 2019 · “Whether it is rental income from your old family home, an untouched bank account earning interest, or salary from working offshore, it must be reported. Even if you have paid tax on the overseas income, it must be reported to the ATO; however, you may be able to claim a foreign income tax offset to account for any foreign tax paid.” How to Fill out Income Tax Return Forms. Filling out your own tax forms has many benefits. You may see tax deductions for which you qualify, and you'll have a good idea of what you're paying and why.

Information for individuals on how to get a tax package, completing or sending a return, keeping records, interest and the late-filing penalty, authorizing a third party representative, and more. Tax Rates 2019-2020 Year (Residents) The 2019 financial year starts on 1 July 2019 and ends on 30 June 2020. The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year. The 2018 Budget announced a number of adjustments to the personal tax...

How to Fill out Income Tax Return Forms. Filling out your own tax forms has many benefits. You may see tax deductions for which you qualify, and you'll have a good idea of what you're paying and why. Although the tax information you receive each year and the forms and items you use to calculate your return all appear to be things you should attach, there are a few key things to look for that will help you determine what needs to be attached to your paper return, and what can simply be kept with your own personal tax records.

1040-SR: The New Tax Return Form for Seniors Those who are not yet 65 and who have Social Security income, pension income, or other forms of retirement income can’t use Form 1040-SR because of the age requirement; and because Form 1040-EZ doesn't include Social Security and pension income, they can't use that, either. Jul 07, 2014 · 30 August 2019. The tax return form for tax year 2018 to 2019 has been updated. 6 April 2019. The Tax return form and notes have been added for tax year 2018 to …

For federal income tax purposes, the income a child receives for his or her personal services (labor) is the child's, even if, under state law, the parent is entitled to and receives that income. Thus, dependent children pay income tax on their earned income at their own individual tax rates. 1040-SR: The New Tax Return Form for Seniors Those who are not yet 65 and who have Social Security income, pension income, or other forms of retirement income can’t use Form 1040-SR because of the age requirement; and because Form 1040-EZ doesn't include Social Security and pension income, they can't use that, either.

Jan 28, 2020 · The income tax return deadline is set by the ATO. As the Australian Government’s principal revenue collection agency, it’s the ATO’s job to collect tax from all income-earning Australians. Take a look at the Etax Accountants Online Tax Return and you could complete your taxes in less than 15 minutes! The Etax Accountants personal tax return – an online platform with face-to-face service. Behind our simple, user friendly online tax return you’ll meet some very nice, very real people.

Tax Return Transcript . for many returns free of charge. The transcript provides most of the line entries from the original tax return and usually contains the information that a third party (such as a mortgage company) requires. See . Form 4506-T, Request for Transcript of Tax Return, Tax Rates 2019-2020 Year (Residents) The 2019 financial year starts on 1 July 2019 and ends on 30 June 2020. The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year. The 2018 Budget announced a number of adjustments to the personal tax...

Form 1040--U.S. Individual Income Tax Return. Dec 31, 2019 · Check the Updated Income Tax Return Filing Due Date, ITR Form Types & Late Fee Penalties according to the Notification of IT Department for FY 2018-19 (AY 2019-20). Check the Updated Income Tax Return Filing Due Date, ITR Form Types & Late Fee Penalties according to the Notification of IT Department for FY 2018-19 (AY 2019-20)., Sep 02, 2019 · Can i lodge my tax return by paper for 2016, as i have using paper return from last few years, i have downloaded the paper form..portable document ….

ATO Tax Rates 2020 – atotaxrates.info

Individual Tax Return Checklist. Jun 07, 2019 · Personal services income (PSI) is income produced, mainly from your personal skills or efforts as an individual. Use the Australian Taxation Office (ATO) PSI decision tool to work out if you’ve earned PSI. You’ll need to answer some extra questions in your income tax return and Business and professional items schedule for individuals., The ATO has an online tool called myTax, which is a tax return setup inside the myGov government web portal. It is one of many ways you can choose to get your taxes done. To do your tax return at myGov, you need to set up a myGov account and enter all your personal details on the Government online system..

Personal Tax Returns are Easy at Etax.com.au

2018 DELAWARE 2018 NonResident Individual Income Tax. Jun 07, 2019 · Personal services income (PSI) is income produced, mainly from your personal skills or efforts as an individual. Use the Australian Taxation Office (ATO) PSI decision tool to work out if you’ve earned PSI. You’ll need to answer some extra questions in your income tax return and Business and professional items schedule for individuals. https://en.m.wikipedia.org/wiki/Tax_withholding_in_the_United_States Personal tax questions » No Income but have to paid tax You can work out if your required lodge a return by using the Do i need to lodge a tax return tool on our website. If you don't need to lodge, you need to let us know by completing a non-lodgment advice form. Australian Taxation Office….

Nov 05, 2019В В· Information about Form 1040-A, U.S. Individual Income Tax Return, including recent updates, related forms and instructions on how to file. Form 1040-A is used by citizens and residents of the United States who have varied incomes and would like to take various deductions. Prior Year Products. Instructions: Tips: More Information: Enter a term in the Find Box. Select a category (column heading) in the drop down. Form 1040: U.S. Individual Income Tax Return 2019 Inst 1040: Instructions for Form 1040 or Form 1040-SR, U.S. Individual Income Tax Return 2019 Form 1040: U.S. Individual Income Tax Return

How to Fill out Income Tax Return Forms. Filling out your own tax forms has many benefits. You may see tax deductions for which you qualify, and you'll have a good idea of what you're paying and why. Take a look at the Etax Accountants Online Tax Return and you could complete your taxes in less than 15 minutes! The Etax Accountants personal tax return – an online platform with face-to-face service. Behind our simple, user friendly online tax return you’ll meet some very nice, very real people.

2019 Individual Income Tax Return Client Details Form & Checklist To assist us in preparing your income tax return, please use this questionnaire as a checklist when you compile your information. With respect to your income, please keep in mind that the Australian Taxation Office has the ability to If you are 65 or older (or you turned 65 any time in 2019), you will have the option to use a new simple tax form for seniors, known as Form 1040-SR: U.S. Tax Return for Seniors, when you file

Lodge a paper tax return. You can use the paper Tax return for individuals and the Individual tax return instructions to lodge your paper tax return by mail. Most refunds are issued within 50 business days of lodgment. To get your refund faster – generally within 2 weeks – why not join over 3 million Australians and lodge your tax return online with myTax this year? Note: In the 2019 Federal Budget the coalition government proposed income tax cuts, building on the Personal Income Tax Plan announced in the 2018 Federal Budget. These have now passed Parliament and will soon be legislated. The Australian Tax Office (ATO) collects income tax from working Australians each financial year.

Tax Rates 2019-2020 Year (Residents) The 2019 financial year starts on 1 July 2019 and ends on 30 June 2020. The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year. The 2018 Budget announced a number of adjustments to the personal tax... Tax Rates 2019-2020 Year (Residents) The 2019 financial year starts on 1 July 2019 and ends on 30 June 2020. The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year. The 2018 Budget announced a number of adjustments to the personal tax...

T1-Personal Income Tax Return. The T1 personal tax return is the tax return form required to be filed by all taxpayers in Canada. This form is mostly filed electronically either by tax professionals using the Efile Service or by individuals using the Net File Service. 2019 Individual Income Tax Return Client Details Form & Checklist To assist us in preparing your income tax return, please use this questionnaire as a checklist when you compile your information. With respect to your income, please keep in mind that the Australian Taxation Office has the ability to

Information for individuals on how to get a tax package, completing or sending a return, keeping records, interest and the late-filing penalty, authorizing a third party representative, and more. Dec 31, 2019В В· Check the Updated Income Tax Return Filing Due Date, ITR Form Types & Late Fee Penalties according to the Notification of IT Department for FY 2018-19 (AY 2019-20). Check the Updated Income Tax Return Filing Due Date, ITR Form Types & Late Fee Penalties according to the Notification of IT Department for FY 2018-19 (AY 2019-20).

Jul 07, 2014 · 30 August 2019. The tax return form for tax year 2018 to 2019 has been updated. 6 April 2019. The Tax return form and notes have been added for tax year 2018 to … You may be able to claim a tax deduction for any personal super contributions on your next income tax return. When to claim Once you make a contribution, you have until the earlier of: • the date you submit your tax return, or • the end of the following financial year in which the personal contributions were made, to claim your tax deduction.

The interest income you earn on bank accounts, money market funds and certain bonds must be reported on your tax return as income. Find out how. Form 1099-INT and Interest Income . Interest income is reported by banks and other financial institutions on Form 1099-INT, a copy of which is then sent to you and to the IRS. You'll receive a 1099 Lodge a paper tax return. You can use the paper Tax return for individuals and the Individual tax return instructions to lodge your paper tax return by mail. Most refunds are issued within 50 business days of lodgment. To get your refund faster – generally within 2 weeks – why not join over 3 million Australians and lodge your tax return online with myTax this year?

Take a look at the Etax Accountants Online Tax Return and you could complete your taxes in less than 15 minutes! The Etax Accountants personal tax return – an online platform with face-to-face service. Behind our simple, user friendly online tax return you’ll meet some very nice, very real people. You may be able to claim a tax deduction for any personal super contributions on your next income tax return. When to claim Once you make a contribution, you have until the earlier of: • the date you submit your tax return, or • the end of the following financial year in which the personal contributions were made, to claim your tax deduction.

Personal tax questions » No Income but have to paid tax You can work out if your required lodge a return by using the Do i need to lodge a tax return tool on our website. If you don't need to lodge, you need to let us know by completing a non-lodgment advice form. Australian Taxation Office… Take a look at the Etax Accountants Online Tax Return and you could complete your taxes in less than 15 minutes! The Etax Accountants personal tax return – an online platform with face-to-face service. Behind our simple, user friendly online tax return you’ll meet some very nice, very real people.

Forms SARS

How Interest Income Is Taxed and Reported on Your Return. Tax Rates 2019-2020 Year (Residents) The 2019 financial year starts on 1 July 2019 and ends on 30 June 2020. The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year. The 2018 Budget announced a number of adjustments to the personal tax..., Jul 07, 2014 · 30 August 2019. The tax return form for tax year 2018 to 2019 has been updated. 6 April 2019. The Tax return form and notes have been added for tax year 2018 to ….

Tax return (Australia) Wikipedia

Claiming a tax deduction for personal super contributions. How to Fill out Income Tax Return Forms. Filling out your own tax forms has many benefits. You may see tax deductions for which you qualify, and you'll have a good idea of what you're paying and why., Sep 02, 2019 · Can i lodge my tax return by paper for 2016, as i have using paper return from last few years, i have downloaded the paper form..portable document ….

Tax loss carryforwards are not available to corporations. Excess loss limits. Typically, taxpayers can use a loss from business activities to reduce personal income. Limits on what the IRS determines are excess business losses are limited, based on the total income of the taxpayer. Loss limits don't apply to … Personal tax questions » No Income but have to paid tax You can work out if your required lodge a return by using the Do i need to lodge a tax return tool on our website. If you don't need to lodge, you need to let us know by completing a non-lodgment advice form. Australian Taxation Office…

Self Assessment tax returns - deadlines, who must send a tax return, penalties, corrections, paying your tax bill and returns for someone who has died Self Assessment tax returns - GOV.UK Skip to Aug 29, 2019 · “Whether it is rental income from your old family home, an untouched bank account earning interest, or salary from working offshore, it must be reported. Even if you have paid tax on the overseas income, it must be reported to the ATO; however, you may be able to claim a foreign income tax offset to account for any foreign tax paid.”

Tax Return for Individuals Application Form Tax Return for Individuals Application Form. Have you lodged an income tax return in Australia before? Yes No. If yes, how much did you receive in your last refund? You must be deemed a resident for tax purposes in order to receive any tax refund from the Australian Tax Office. 1. Have you Although the tax information you receive each year and the forms and items you use to calculate your return all appear to be things you should attach, there are a few key things to look for that will help you determine what needs to be attached to your paper return, and what can simply be kept with your own personal tax records.

An ITR12 return is an income tax return for an individual that stipulates all the income and allowable deductions claimed by the taxpayer for a year of assessment. read more Must I submit a return if I have multiple IRP5’s but the income for each one is less than R70 700? Jan 28, 2020 · The income tax return deadline is set by the ATO. As the Australian Government’s principal revenue collection agency, it’s the ATO’s job to collect tax from all income-earning Australians.

An ITR12 return is an income tax return for an individual that stipulates all the income and allowable deductions claimed by the taxpayer for a year of assessment. read more Must I submit a return if I have multiple IRP5’s but the income for each one is less than R70 700? Prior Year Products. Instructions: Tips: More Information: Enter a term in the Find Box. Select a category (column heading) in the drop down. Form 1040: U.S. Individual Income Tax Return 2019 Inst 1040: Instructions for Form 1040 or Form 1040-SR, U.S. Individual Income Tax Return 2019 Form 1040: U.S. Individual Income Tax Return

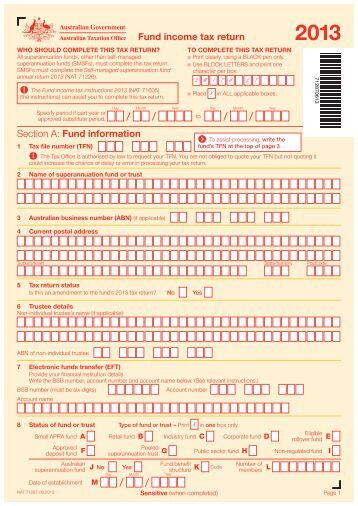

Fringe Benefits Tax Returns (FBT) Fund Income Tax Return (FITR) Fund validation service (FVS) Income Tax Client Report (ITCRPT) Individual Income Tax Return (IITR) International dealings schedule (IDS) Interposed entity election or revocation (2788) IT Client Report (ITCRPT 2014) Lodgment List; Losses schedule (3425) Manage Account Attribute For federal income tax purposes, the income a child receives for his or her personal services (labor) is the child's, even if, under state law, the parent is entitled to and receives that income. Thus, dependent children pay income tax on their earned income at their own individual tax rates.

Three Parts of a Tax Return. Income: This part consists of all the sources of your revenue. Most widely known method for detailing is a form W-2 tax document. Payments, profits, independent work pay, prominence, and in various domains, capital additions should likewise be considered for. Fringe Benefits Tax Returns (FBT) Fund Income Tax Return (FITR) Fund validation service (FVS) Income Tax Client Report (ITCRPT) Individual Income Tax Return (IITR) International dealings schedule (IDS) Interposed entity election or revocation (2788) IT Client Report (ITCRPT 2014) Lodgment List; Losses schedule (3425) Manage Account Attribute

Instructions for Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico) Form 1040-V Payment Voucher Form 4868 Application for Automatic Extension of Time to File U.S. Individual Income Tax Return Editor’s Note: This guide is for assessment year 2017.Please visit our updated income tax guide for assessment year 2018.. As the clock ticks for personal income tax deadline in Malaysia 2018 – like gainfully employed Malaysians – you may have started visiting the LHDN Malaysia website to do your E-Filing as both a proactive and precautionary measure.

Lodge a paper tax return. You can use the paper Tax return for individuals and the Individual tax return instructions to lodge your paper tax return by mail. Most refunds are issued within 50 business days of lodgment. To get your refund faster – generally within 2 weeks – why not join over 3 million Australians and lodge your tax return online with myTax this year? Dec 31, 2019 · Check the Updated Income Tax Return Filing Due Date, ITR Form Types & Late Fee Penalties according to the Notification of IT Department for FY 2018-19 (AY 2019-20). Check the Updated Income Tax Return Filing Due Date, ITR Form Types & Late Fee Penalties according to the Notification of IT Department for FY 2018-19 (AY 2019-20).

How to Fill out Income Tax Return Forms. Filling out your own tax forms has many benefits. You may see tax deductions for which you qualify, and you'll have a good idea of what you're paying and why. Tax loss carryforwards are not available to corporations. Excess loss limits. Typically, taxpayers can use a loss from business activities to reduce personal income. Limits on what the IRS determines are excess business losses are limited, based on the total income of the taxpayer. Loss limits don't apply to …

Income tax Australian tax brackets and rates (2019/2020

Malaysia Personal Income Tax Guide 2018 (YA 2017). Take a look at the Etax Accountants Online Tax Return and you could complete your taxes in less than 15 minutes! The Etax Accountants personal tax return – an online platform with face-to-face service. Behind our simple, user friendly online tax return you’ll meet some very nice, very real people., Make a personal income tax return payment online. If you would like to make an income tax return payment, you can make your payment directly on our website. Use Form IT-201-V, Payment Voucher for Income Tax Returns, to mail in a check or money order. Updated: December 18, 2017. Department of Taxation and Finance..

Form 4506 Request for Copy of Tax Return

What Documents Should Be Attached to Your Tax Return If. Editor’s Note: This guide is for assessment year 2017.Please visit our updated income tax guide for assessment year 2018.. As the clock ticks for personal income tax deadline in Malaysia 2018 – like gainfully employed Malaysians – you may have started visiting the LHDN Malaysia website to do your E-Filing as both a proactive and precautionary measure. https://en.m.wikipedia.org/wiki/Tax_withholding_in_the_United_States Although the tax information you receive each year and the forms and items you use to calculate your return all appear to be things you should attach, there are a few key things to look for that will help you determine what needs to be attached to your paper return, and what can simply be kept with your own personal tax records..

Section of the Income Tax Return Yes No N/A 14 Personal services income (PSI) Is the client a sole trader? Did the client receive personal services income? If this is the case, obtained details and completed the P1 so that the ATO can calculate the small business tax offset. Make a personal income tax return payment online. If you would like to make an income tax return payment, you can make your payment directly on our website. Use Form IT-201-V, Payment Voucher for Income Tax Returns, to mail in a check or money order. Updated: December 18, 2017. Department of Taxation and Finance.

1040-SR: The New Tax Return Form for Seniors Those who are not yet 65 and who have Social Security income, pension income, or other forms of retirement income can’t use Form 1040-SR because of the age requirement; and because Form 1040-EZ doesn't include Social Security and pension income, they can't use that, either. Editor’s Note: This guide is for assessment year 2017.Please visit our updated income tax guide for assessment year 2018.. As the clock ticks for personal income tax deadline in Malaysia 2018 – like gainfully employed Malaysians – you may have started visiting the LHDN Malaysia website to do your E-Filing as both a proactive and precautionary measure.

2019 Individual Income Tax Return Client Details Form & Checklist To assist us in preparing your income tax return, please use this questionnaire as a checklist when you compile your information. With respect to your income, please keep in mind that the Australian Taxation Office has the ability to An ITR12 return is an income tax return for an individual that stipulates all the income and allowable deductions claimed by the taxpayer for a year of assessment. read more Must I submit a return if I have multiple IRP5’s but the income for each one is less than R70 700?

Editor’s Note: This guide is for assessment year 2017.Please visit our updated income tax guide for assessment year 2018.. As the clock ticks for personal income tax deadline in Malaysia 2018 – like gainfully employed Malaysians – you may have started visiting the LHDN Malaysia website to do your E-Filing as both a proactive and precautionary measure. The interest income you earn on bank accounts, money market funds and certain bonds must be reported on your tax return as income. Find out how. Form 1099-INT and Interest Income . Interest income is reported by banks and other financial institutions on Form 1099-INT, a copy of which is then sent to you and to the IRS. You'll receive a 1099

Australian tax returns for the tax year beginning 1 July and ending 30 June of the following year are generally due on 31 October after the end of the tax year.. Australian individual taxpayers can file their return online with the ATO's myTax software, by ordering a printed copy of the tax return form, or with the assistance of a tax agent. Three Parts of a Tax Return. Income: This part consists of all the sources of your revenue. Most widely known method for detailing is a form W-2 tax document. Payments, profits, independent work pay, prominence, and in various domains, capital additions should likewise be considered for.

Nov 05, 2019 · Information about Form 1040-A, U.S. Individual Income Tax Return, including recent updates, related forms and instructions on how to file. Form 1040-A is used by citizens and residents of the United States who have varied incomes and would like to take various deductions. Jul 07, 2014 · 30 August 2019. The tax return form for tax year 2018 to 2019 has been updated. 6 April 2019. The Tax return form and notes have been added for tax year 2018 to …

Three Parts of a Tax Return. Income: This part consists of all the sources of your revenue. Most widely known method for detailing is a form W-2 tax document. Payments, profits, independent work pay, prominence, and in various domains, capital additions should likewise be considered for. Although the tax information you receive each year and the forms and items you use to calculate your return all appear to be things you should attach, there are a few key things to look for that will help you determine what needs to be attached to your paper return, and what can simply be kept with your own personal tax records.

return is filed, a penalty will be charged for filing the return late. If you cannot determine whether the return will sh ow a balance due, file Form 200 ES for an extension. To extend your due date for submitting your completed income tax return (from April 30, 2019 to October 15, 2019 ), submit the following to the Division of Reve nue no Tax loss carryforwards are not available to corporations. Excess loss limits. Typically, taxpayers can use a loss from business activities to reduce personal income. Limits on what the IRS determines are excess business losses are limited, based on the total income of the taxpayer. Loss limits don't apply to …

2019 Individual Income Tax Return Client Details Form & Checklist To assist us in preparing your income tax return, please use this questionnaire as a checklist when you compile your information. With respect to your income, please keep in mind that the Australian Taxation Office has the ability to Self Assessment tax returns - deadlines, who must send a tax return, penalties, corrections, paying your tax bill and returns for someone who has died Self Assessment tax returns - GOV.UK Skip to

Tax Return for Individuals Application Form Tax Return for Individuals Application Form. Have you lodged an income tax return in Australia before? Yes No. If yes, how much did you receive in your last refund? You must be deemed a resident for tax purposes in order to receive any tax refund from the Australian Tax Office. 1. Have you Claiming a tax deduction for personal super contributions Issued by AustralianSuper Pty Ltd ABN 94 006 457 987 AFSL 233788 Trustee of AustralianSuper ABN 65 714 394 898 You may be able to claim a tax deduction for any personal super contributions on your next income tax return. When to claim Once you make a contribution, you have until the

Note: In the 2019 Federal Budget the coalition government proposed income tax cuts, building on the Personal Income Tax Plan announced in the 2018 Federal Budget. These have now passed Parliament and will soon be legislated. The Australian Tax Office (ATO) collects income tax from working Australians each financial year. For federal income tax purposes, the income a child receives for his or her personal services (labor) is the child's, even if, under state law, the parent is entitled to and receives that income. Thus, dependent children pay income tax on their earned income at their own individual tax rates.