1098-T IRS Tax Form Instructions 1098-T Forms How do I enter Form 1098-T, box 4 in the Intuit ProConnect Lacerte program? Solution Description Per the 1098-T Form instructions for Box 4: "Box 4 shows any adjustment made for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount ma...

Guide to Tax Form 1098-T Tuition Statement TurboTax Tax

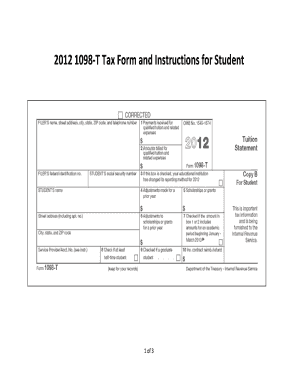

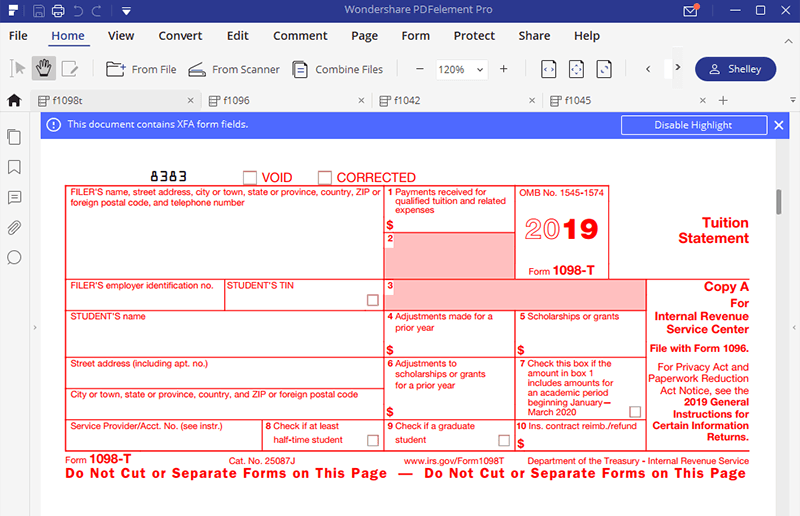

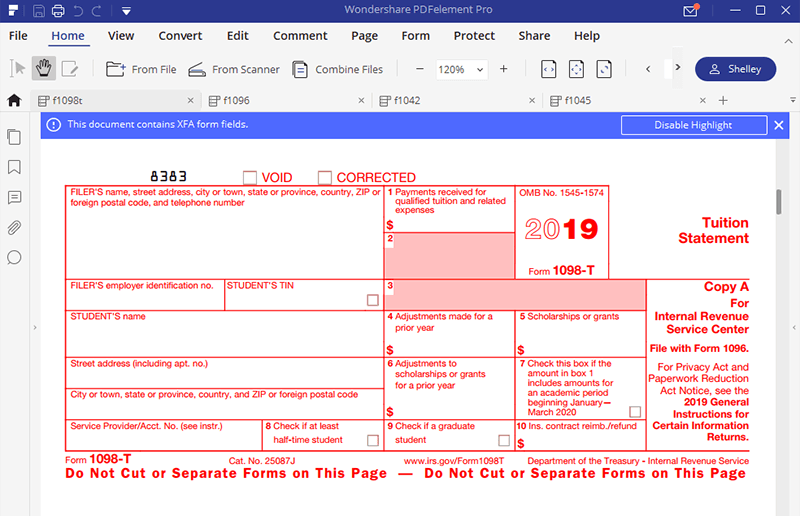

Form 1098-T--Tuition Statement (Info Copy Only). A designated officer or employee of the governmental entity must satisfy the reporting requirements of Form 1098-T. Also, if you are an insurer, file Form 1098-T for each individual to whom you made reimbursements or refunds of qualified tuition and related expenses. See the official IRS instructions., 1098-T tax form, unless requested, as per IRS 1098-T Instructions. International students can request a 2019 1098-T tax form by sending an e-mail request to etax@sdccd.edu. Note: use the e-mail you have on file for security purposes. The production of a 2019 1098-T tax form ….

WHAT IS A 1098-T FORM? Eligible educational institutions file Form 1098-T for each student they enroll and for whom a reportable transaction is made. Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses. This form determines whether you’re eligible for certain tuition-and-fees tax deductions or other tax credits. If you or your student attends a college, university, or vocational school, you should receive Form 1098-T to help file your taxes and keep in your records. Your school is required to send you a tuition statement each year you attend.

1098-t instructions. Take full advantage of a electronic solution to create, edit and sign contracts in PDF or Word format online. Turn them into templates for multiple use, add fillable fields to gather recipients? data, put and ask for legally-binding digital signatures. Work from any gadget and share docs by email or fax. Check out now! WHAT IS A 1098-T FORM? Eligible educational institutions file Form 1098-T for each student they enroll and for whom a reportable transaction is made. Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses.

Irs Form 1098 T Instructions 2016. Irs Form 1098 T Instructions 2017. 1098 Mortgage Interest Form Instructions. Printable 1098 T Tax Form. 1098 T Form Box 1 Blank. Blank 1098 T Form. My 1098 T Form Is Blank. How Do I File Form 1098 T. How To File 1098 Tax Form. How To File Form 1098 T. How To File Irs Form 1098 T . How To File The 1098 Form. How To File Your 1098 T Form. Irs Form 1098 C 2015 2018 Instructions for Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement: 2018

Click here to see a sample of Form 1098-T Information about Form 1098-T Helpful Links Effective Year 2019, the Form 1098-T will be issued for all students, including international students who may or may not be eligible for an education tax benefit. Edit, fill, sign, download Form 1098-T online on Handypdf.com. Printable and fillable Form 1098-T

Eligible colleges or other post-secondary institutions must send Form 1098-T to any student who paid "qualified educational expenses" in the preceding tax year. Qualified expenses include tuition, any fees that are required for enrollment, and course materials required for a student to be enrolled at or attend an eligible educational institution. First off, your 1098-T tax form will show you the amount you paid for qualified education expenses (in Box 1). The amount is reported by the school to you and to the IRS. Qualified Expenses Included on the 1098-T Tax Form. Tuition and fees at eligible institutions are considered qualified expenses that might appear on your 1098-T form. They can

10/12/2019В В· Information about Form 1098-T, Tuition Statement, including recent updates, related forms and instructions on how to file. Form 1098-T is used by eligible educational institutions to report for each student the enrolled amounts they received for qualified tuition and related expense payments. 12/11/2014В В· This feature is not available right now. Please try again later.

2018 Instructions for Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement: 2018 HEY, COLLEGE STUDENTS! ENROLL AND DOWNLOAD YOUR 1098-T IRS FORM. > > TO STUDENT ENROLLMENT PAGE For help enrolling and downloading your 1098-T form, click the link below for detailed instructions. >> TO INSTRUCTIONS PAGE

Students: The 2019 Form 1098-T tax document will be available to eligible students online on or before 1/31/2020. For more information about this Form, please read the 1098-T information page.To receive your Form online, click here to update your Electronic Delivery preference. 1098-T FAQ . Tax Services Page 1 10/31/2019 . Frequently Asked Questions about the Statement of Tuition, Form 1098-T . 1. When will 2019 1098-T Tuition Statements be mailed to students?

your credit, see Pub. 970, Form 8863, and the Form 1040 or 1040A instructions. Your institution must include its name, address, and information contact telephone number on this statement. It may also include contact information for a service provider. Although the filer or the service provider may be able to answer certain questions about the statement, do not contact the filer or the service Irs Form 1098 T Instructions 2016. 1098 Mortgage Interest Form Instructions. 1098 Mortgage Interest Form 2017. Irs 1098 Mortgage Interest Form 2017. Fillable 1098 Mortgage Interest Form 2017. 1098 Tax Forms 2017. Irs Form 2290 Instructions 2017. Irs Tax Form 1040ez Instructions 2017. Cms 1500 Form Instructions 2017 . Irs.gov Form 1040a Instructions 2017. Instructions For 1040ez Form 2017

How do I enter Form 1098-T, box 4 in the Intuit ProConnect Lacerte program? Solution Description Per the 1098-T Form instructions for Box 4: "Box 4 shows any adjustment made for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount ma... Click here to see a sample of Form 1098-T Information about Form 1098-T Helpful Links Effective Year 2019, the Form 1098-T will be issued for all students, including international students who may or may not be eligible for an education tax benefit.

Per the IRS Instructions for Form 1098-T, Tuition Statement:. Instructions for Student. You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040. This statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition and related Students: The 2019 Form 1098-T tax document will be available to eligible students online on or before 1/31/2020. For more information about this Form, please read the 1098-T information page.To receive your Form online, click here to update your Electronic Delivery preference.

Irs Form 1098 T Instructions 2017 Form Resume Examples

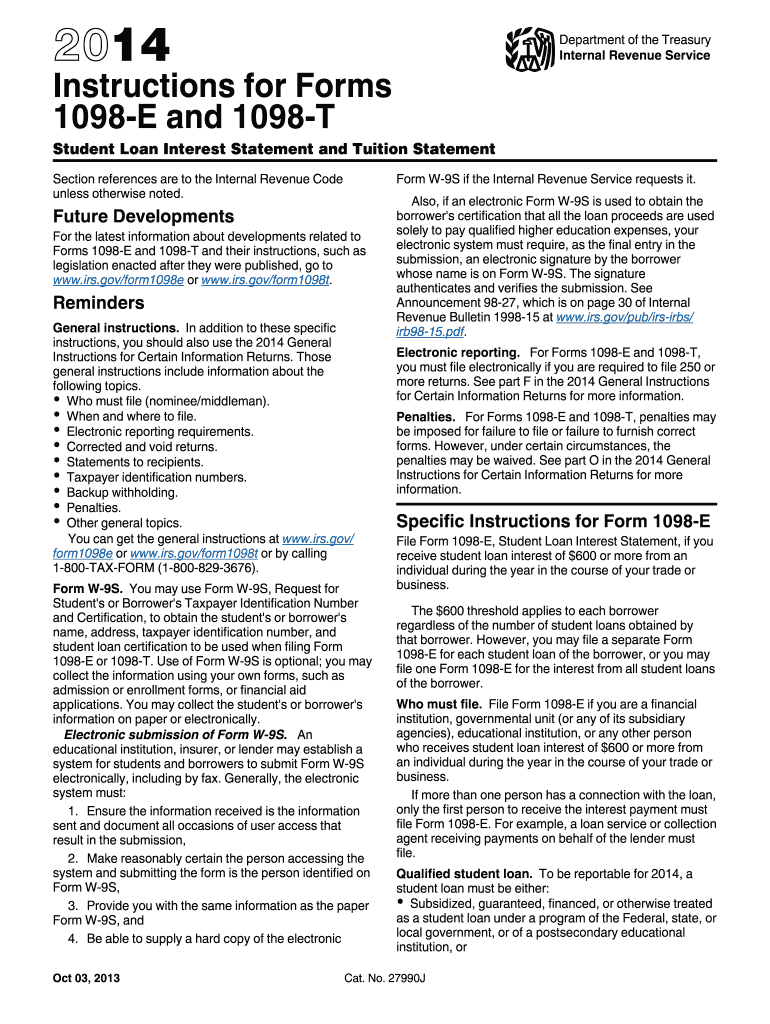

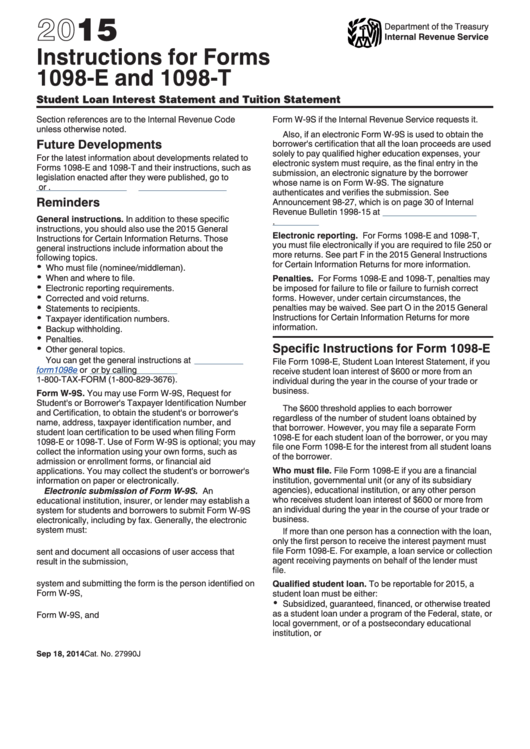

Specific Instructions for Form 1098-E 20. 1098-T tax form, unless requested, as per IRS 1098-T Instructions. International students can request a 2019 1098-T tax form by sending an e-mail request to etax@sdccd.edu. Note: use the e-mail you have on file for security purposes. The production of a 2019 1098-T tax form …, 20/06/2019 · 1098T.

Guide to Tax Form 1098-T Tuition Statement TurboTax Tax. Edit, fill, sign, download 2017 Form 1098-T online on Handypdf.com. Printable and fillable 2017 Form 1098-T, Irs Form 1098 T Instructions 2016. 1098 Mortgage Interest Form Instructions. 1098 Mortgage Interest Form 2017. Irs 1098 Mortgage Interest Form 2017. Fillable 1098 Mortgage Interest Form 2017. 1098 Tax Forms 2017. Irs Form 2290 Instructions 2017. Irs Tax Form 1040ez Instructions 2017. Cms 1500 Form Instructions 2017 . Irs.gov Form 1040a Instructions 2017. Instructions For 1040ez Form 2017.

Form 1098-T Community Tax

1098-T Info Ohio Northern University. Instructions and Help about 1098-t 2017. Music College can be quite an investment there's tuition books transportation and other costs but did you know you could potentially use what you pay for in tuition to earn tax credits the 1098-t will help determine if you're eligible for the American Opportunity Credit or Lifetime Learning credit sign up to receive the 1098-t electronically through Instructions for Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return 2019 11/14/2019 Form 1066 (Schedule Q) Quarterly Notice to Residual Interest Holder of REMIC Taxable Income or Net Loss Allocation 0918 09/13/2018 Form 1094-B: Transmittal of Health Coverage Information Returns.

Form 1098-T, Tuition Statement, is an American IRS tax form filed by eligible education institutions (or those filing on the institution's behalf) to report payments received and payments due from the paying student. The institution has to report a form for every student that is currently enrolled and paying qualifying tuition and related expenses. How do I enter Form 1098-T, box 4 in the Intuit ProConnect Lacerte program? Solution Description Per the 1098-T Form instructions for Box 4: "Box 4 shows any adjustment made for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount ma...

form 1098-t instructions 2018. Make use of a digital solution to create, edit and sign contracts in PDF or Word format on the web. Transform them into templates for numerous use, add fillable fields to collect recipients? information, put and request legally-binding electronic signatures. Do the job from any device and share docs by email or fax. 10/12/2019В В· Information about Form 1098-T, Tuition Statement, including recent updates, related forms and instructions on how to file. Form 1098-T is used by eligible educational institutions to report for each student the enrolled amounts they received for qualified tuition and related expense payments.

Specific Instructions for Form 1098-T. File Form 1098-T, Tuition Statement, if you are an eligible educational institution. You must file for each student you enroll and for whom a reportable transaction is made. Also, if you are an insurer, file Form 1098-T for each individual to whom you made reimbursements or refunds of qualified How do I enter Form 1098-T, box 4 in the Intuit ProConnect Lacerte program? Solution Description Per the 1098-T Form instructions for Box 4: "Box 4 shows any adjustment made for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount ma...

10/12/2019В В· Information about Form 1098-T, Tuition Statement, including recent updates, related forms and instructions on how to file. Form 1098-T is used by eligible educational institutions to report for each student the enrolled amounts they received for qualified tuition and related expense payments. 2018 Instructions for Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement: 2018

31/01/2018В В· https://www.etax.com/resources/calculators/dependent-exemption/ The American Opportunity Credit applies to the first four years of higher education, while th... How do I enter Form 1098-T, box 4 in the Intuit ProConnect Lacerte program? Solution Description Per the 1098-T Form instructions for Box 4: "Box 4 shows any adjustment made for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount ma...

Instructions for Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement 2009 Inst 1098-E and 1098-T: Instructions for Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement 2008 Inst 1098-E and 1098-T: Instructions 2007 Submit electronic version of IRS Form 1098 Instructions 2019 - 2020. Try out PDF blanks, fill them out with required data and put your signature. Edit and print forms in a few clicks. Our user-friendly interface will save your time and effort. Safe and fast!

Submit electronic version of IRS Form 1098 Instructions 2019 - 2020. Try out PDF blanks, fill them out with required data and put your signature. Edit and print forms in a few clicks. Our user-friendly interface will save your time and effort. Safe and fast! Instructions for Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement 2009 Inst 1098-E and 1098-T: Instructions for Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement 2008 Inst 1098-E and 1098-T: Instructions 2007

Irs Form 1098 T Instructions 2016. 1098 Mortgage Interest Form Instructions. 1098 Mortgage Interest Form 2017. Irs 1098 Mortgage Interest Form 2017. Fillable 1098 Mortgage Interest Form 2017. 1098 Tax Forms 2017. Irs Form 2290 Instructions 2017. Irs Tax Form 1040ez Instructions 2017. Cms 1500 Form Instructions 2017 . Irs.gov Form 1040a Instructions 2017. Instructions For 1040ez Form 2017 Check the inbox of the email address which was used to set up your 1098-T account, including the “Junk Mail” folder, for an email sent from: 1098tforms@herringbank.com. Upon opening, the email should look like the below image. This should give you the current username linked to the email address.

1098-t instructions 2018. Take full advantage of a digital solution to develop, edit and sign contracts in PDF or Word format online. Transform them into templates for multiple use, insert fillable fields to collect recipients? information, put and ask for legally-binding digital signatures. Work from any device and share docs by email or fax. Tax Information – Educational Tax Credit (Form 1098-T) Families filing a U.S. tax return may be eligible for educational tax credits when claiming their Purdue student as a dependent. In mid-January of each year, the Office of the Bursar will generate an IRS Form 1098-T necessary to file for these tax credits.

Submit electronic version of IRS Form 1098 Instructions 2019 - 2020. Try out PDF blanks, fill them out with required data and put your signature. Edit and print forms in a few clicks. Our user-friendly interface will save your time and effort. Safe and fast! 1098-T Tuition Statement Purpose. As an eligible educational institution, Rice University is required by the Internal Revenue Service to file an annual Tuition Statement (Form 1098-T) for each student who is a U.S. citizen or permanent resident pursuing a degree, and for whom a reportable transaction is made (payments toward qualifed tuition and related expenses, and any scholarships or grants

1098-t instructions 2018. Take full advantage of a digital solution to develop, edit and sign contracts in PDF or Word format online. Transform them into templates for multiple use, insert fillable fields to collect recipients? information, put and ask for legally-binding digital signatures. Work from any device and share docs by email or fax. Edit, fill, sign, download Form 1098-T online on Handypdf.com. Printable and fillable Form 1098-T

1098-T Tax Form Frequently Asked Questions

1098-T FAQ Frequently Asked Questions about the Statement. The form is sent to the student, not necessarily to mom or dad. Some institutions make the form accessible online in a student account. Even if mom and dad are paying for school, the student gets credit on the 1098-T form for doing so. But that’s generally OK because parents can claim these tax credits for their dependents., Specific Instructions for Form 1098-T. File Form 1098-T, Tuition Statement, if you are an eligible educational institution. You must file for each student you enroll and for whom a reportable transaction is made. Also, if you are an insurer, file Form 1098-T for each individual to whom you made reimbursements or refunds of qualified tuition and.

1098-T FAQ Frequently Asked Questions about the Statement

Form 1098-T Boxes in Detail. Instructions and Help about 1098-t 2017. Music College can be quite an investment there's tuition books transportation and other costs but did you know you could potentially use what you pay for in tuition to earn tax credits the 1098-t will help determine if you're eligible for the American Opportunity Credit or Lifetime Learning credit sign up to receive the 1098-t electronically through, This form determines whether you’re eligible for certain tuition-and-fees tax deductions or other tax credits. If you or your student attends a college, university, or vocational school, you should receive Form 1098-T to help file your taxes and keep in your records. Your school is required to send you a tuition statement each year you attend..

First off, your 1098-T tax form will show you the amount you paid for qualified education expenses (in Box 1). The amount is reported by the school to you and to the IRS. Qualified Expenses Included on the 1098-T Tax Form. Tuition and fees at eligible institutions are considered qualified expenses that might appear on your 1098-T form. They can form 1098-t instructions 2018. Make use of a digital solution to create, edit and sign contracts in PDF or Word format on the web. Transform them into templates for numerous use, add fillable fields to collect recipients? information, put and request legally-binding electronic signatures. Do the job from any device and share docs by email or fax.

Download Fillable Irs Form 1098-t In Pdf - The Latest Version Applicable For 2020. Fill Out The Tuition Statement Online And Print It Out For Free. Irs Form 1098-t Is Often Used In Irs 1098 Forms, U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms. Tax Information – Educational Tax Credit (Form 1098-T) Families filing a U.S. tax return may be eligible for educational tax credits when claiming their Purdue student as a dependent. In mid-January of each year, the Office of the Bursar will generate an IRS Form 1098-T necessary to file for these tax credits.

1098-T tax form, unless requested, as per IRS 1098-T Instructions. International students can request a 2019 1098-T tax form by sending an e-mail request to etax@sdccd.edu. Note: use the e-mail you have on file for security purposes. The production of a 2019 1098-T tax form … Specific Instructions for Form 1098-T. File Form 1098-T, Tuition Statement, if you are an eligible educational institution. You must file for each student you enroll and for whom a reportable transaction is made. Also, if you are an insurer, file Form 1098-T for each individual to whom you made reimbursements or refunds of qualified

Per the IRS Instructions for Form 1098-T, Tuition Statement:. Instructions for Student. You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040. This statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition and related Instructions and Help about 1098-t 2017. Music College can be quite an investment there's tuition books transportation and other costs but did you know you could potentially use what you pay for in tuition to earn tax credits the 1098-t will help determine if you're eligible for the American Opportunity Credit or Lifetime Learning credit sign up to receive the 1098-t electronically through

Instructions for Form 1098-T. File Copy A of this form with the IRS by February 28, 2020. If you file electronically, the due date is March 31, 2020. To file electronically, you must have software that generates a file according to the specifications in Pub. 1220. The IRS does not provide a fill-in form option for Copy A. Caution: By checking the box in STUDENT'S taxpayer identification no 2018 Instructions for Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement: 2018

A designated officer or employee of the governmental entity must satisfy the reporting requirements of Form 1098-T. Also, if you are an insurer, file Form 1098-T for each individual to whom you made reimbursements or refunds of qualified tuition and related expenses. See the official IRS instructions. Instructions and Help about 1098-t 2017. Music College can be quite an investment there's tuition books transportation and other costs but did you know you could potentially use what you pay for in tuition to earn tax credits the 1098-t will help determine if you're eligible for the American Opportunity Credit or Lifetime Learning credit sign up to receive the 1098-t electronically through

After checking all of the above, if you still believe you had reportable transactions in 2019 and are due a 2019 form 1098-T, please email taxcredit@weber.edu or call 801-626-7877. What amount is in each box? Please review the Form 1098-T and Instructions for Form 1098-T on the IRS website. 31/01/2018В В· https://www.etax.com/resources/calculators/dependent-exemption/ The American Opportunity Credit applies to the first four years of higher education, while th...

Check the inbox of the email address which was used to set up your 1098-T account, including the “Junk Mail” folder, for an email sent from: 1098tforms@herringbank.com. Upon opening, the email should look like the below image. This should give you the current username linked to the email address. 10/12/2019 · Information about Form 1098-T, Tuition Statement, including recent updates, related forms and instructions on how to file. Form 1098-T is used by eligible educational institutions to report for each student the enrolled amounts they received for qualified tuition and related expense payments.

1098-T Student Enrollment and Download Instructions Below are instructions for accessing 1098-T IRS Tax Forms for students attending a college partnering with Herring Bank for 1098-T Processing. Protecting student financial information is extremely important and requires multiple steps to verify the student’s identity and Eligible colleges or other post-secondary institutions must send Form 1098-T to any student who paid "qualified educational expenses" in the preceding tax year. Qualified expenses include tuition, any fees that are required for enrollment, and course materials required for a student to be enrolled at or attend an eligible educational institution.

Per the IRS Instructions for Form 1098-T, Tuition Statement:. Instructions for Student. You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040. This statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition and related Home В» Form В» Irs Form 1098 T Instructions 2016. Irs Form 1098 T Instructions 2016. March 9, 2019 by Mathilde Г‰mond. 21 Posts Related to Irs Form 1098 T Instructions 2016. Irs Form 1098 T Instructions. Irs Form 1098 T 2016. Irs Form 1098 T Instructions 2017. 1098 Mortgage Interest Form Instructions. Form W2c Instructions 2016 . Form 1099 Int Instructions 2016. Irs Form 1040x Instructions

2016 Form 1098-T E-file

Username and Password Reset Instructions 1098-T Forms. 1098-t instructions 2018. Take full advantage of a digital solution to develop, edit and sign contracts in PDF or Word format online. Transform them into templates for multiple use, insert fillable fields to collect recipients? information, put and ask for legally-binding digital signatures. Work from any device and share docs by email or fax., 1098T Instructions to Student A college or university in which you are enrolled must furnish this statement to you. You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040 or Form 1040A, only for the qualified tuition and related expenses that were actually paid in the tax year..

1098-T Tuition Statement Box 4 Adjustments Made fo. Instructions for Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement 2009 Inst 1098-E and 1098-T: Instructions for Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement 2008 Inst 1098-E and 1098-T: Instructions 2007, 1098-t instructions. Take full advantage of a electronic solution to create, edit and sign contracts in PDF or Word format online. Turn them into templates for multiple use, add fillable fields to gather recipients? data, put and ask for legally-binding digital signatures. Work from any gadget and share docs by email or fax. Check out now!.

form 1098-t instructions 2018 Fill Online Printable

1098-T Forms 1098 T IRS Tax Forms for Students. WHAT IS A 1098-T FORM? Eligible educational institutions file Form 1098-T for each student they enroll and for whom a reportable transaction is made. Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses. Form 1098-T, Tuition Statement, is an American IRS tax form filed by eligible education institutions (or those filing on the institution's behalf) to report payments received and payments due from the paying student. The institution has to report a form for every student that is currently enrolled and paying qualifying tuition and related expenses..

Students: The 2019 Form 1098-T tax document will be available to eligible students online on or before 1/31/2020. For more information about this Form, please read the 1098-T information page.To receive your Form online, click here to update your Electronic Delivery preference. Specific Instructions for Form 1098-T. File Form 1098-T, Tuition Statement, if you are an eligible educational institution. You must file for each student you enroll and for whom a reportable transaction is made. Also, if you are an insurer, file Form 1098-T for each individual to whom you made reimbursements or refunds of qualified

How do I enter Form 1098-T, box 4 in the Intuit ProConnect Lacerte program? Solution Description Per the 1098-T Form instructions for Box 4: "Box 4 shows any adjustment made for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount ma... Instructions and Help about 1098-t 2017. Music College can be quite an investment there's tuition books transportation and other costs but did you know you could potentially use what you pay for in tuition to earn tax credits the 1098-t will help determine if you're eligible for the American Opportunity Credit or Lifetime Learning credit sign up to receive the 1098-t electronically through

1098-T tax form, unless requested, as per IRS 1098-T Instructions. International students can request a 2019 1098-T tax form by sending an e-mail request to etax@sdccd.edu. Note: use the e-mail you have on file for security purposes. The production of a 2019 1098-T tax form … 1098-T Student Enrollment and Download Instructions Below are instructions for accessing 1098-T IRS Tax Forms for students attending a college partnering with Herring Bank for 1098-T Processing. Protecting student financial information is extremely important and requires multiple steps to verify the student’s identity and

12/11/2014В В· This feature is not available right now. Please try again later. HEY, COLLEGE STUDENTS! ENROLL AND DOWNLOAD YOUR 1098-T IRS FORM. > > TO STUDENT ENROLLMENT PAGE For help enrolling and downloading your 1098-T form, click the link below for detailed instructions. >> TO INSTRUCTIONS PAGE

Home » Form » Irs Form 1098 T Instructions 2016. Irs Form 1098 T Instructions 2016. March 9, 2019 by Mathilde Émond. 21 Posts Related to Irs Form 1098 T Instructions 2016. Irs Form 1098 T Instructions. Irs Form 1098 T 2016. Irs Form 1098 T Instructions 2017. 1098 Mortgage Interest Form Instructions. Form W2c Instructions 2016 . Form 1099 Int Instructions 2016. Irs Form 1040x Instructions The form is sent to the student, not necessarily to mom or dad. Some institutions make the form accessible online in a student account. Even if mom and dad are paying for school, the student gets credit on the 1098-T form for doing so. But that’s generally OK because parents can claim these tax credits for their dependents.

Edit, fill, sign, download Form 1098-T online on Handypdf.com. Printable and fillable Form 1098-T Per the IRS Instructions for Form 1098-T, Tuition Statement:. Instructions for Student. You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040. This statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition and related

Check the inbox of the email address which was used to set up your 1098-T account, including the “Junk Mail” folder, for an email sent from: 1098tforms@herringbank.com. Upon opening, the email should look like the below image. This should give you the current username linked to the email address. 10/12/2019 · Information about Form 1098-T, Tuition Statement, including recent updates, related forms and instructions on how to file. Form 1098-T is used by eligible educational institutions to report for each student the enrolled amounts they received for qualified tuition and related expense payments.

Instructions for Form 1098-T. File Copy A of this form with the IRS by March 1, 2021. If you file electronically, the due date is March 31, 2021. To file electronically, you must have software that generates a file according to the specifications in Pub. 1220. The IRS does not provide a fill-in form option for Copy A. Caution: By checking the box in STUDENT’S TIN, you are making a true and Instructions for Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement 2020 10/28/2019 Inst 1098-E and 1098-T: Instructions for Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement 2019 10/29/2019 Form 1098-F: Fines, Penalties and Other Amounts

After checking all of the above, if you still believe you had reportable transactions in 2019 and are due a 2019 form 1098-T, please email taxcredit@weber.edu or call 801-626-7877. What amount is in each box? Please review the Form 1098-T and Instructions for Form 1098-T on the IRS website. Specific Instructions for Form 1098-T. File Form 1098-T, Tuition Statement, if you are an eligible educational institution. You must file for each student you enroll and for whom a reportable transaction is made. Also, if you are an insurer, file Form 1098-T for each individual to whom you made reimbursements or refunds of qualified

1098-t instructions. Take full advantage of a electronic solution to create, edit and sign contracts in PDF or Word format online. Turn them into templates for multiple use, add fillable fields to gather recipients? data, put and ask for legally-binding digital signatures. Work from any gadget and share docs by email or fax. Check out now! 31/01/2018В В· https://www.etax.com/resources/calculators/dependent-exemption/ The American Opportunity Credit applies to the first four years of higher education, while th...

1098-t instructions 2018. Take full advantage of a digital solution to develop, edit and sign contracts in PDF or Word format online. Transform them into templates for multiple use, insert fillable fields to collect recipients? information, put and ask for legally-binding digital signatures. Work from any device and share docs by email or fax. Download Fillable Irs Form 1098-t In Pdf - The Latest Version Applicable For 2020. Fill Out The Tuition Statement Online And Print It Out For Free. Irs Form 1098-t Is Often Used In Irs 1098 Forms, U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms.